The Market Season Begins June 14th!

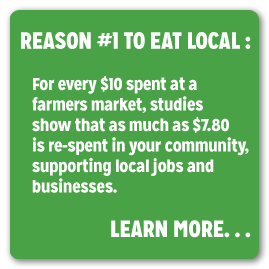

The North End Farmers Market will be open Friday, June 14th at 10am. We're excited to welcome back our returning farms and can't wait to sink our teeth into some fresh, locally grown fruits and vegetables. Back by popular demand, the Double Dollars program will be matching the funds of customers who shop with WIC/Senior Vouchers and EBT/SNAP assistance. We hope to see you there!